For users from the US, Canada, Australia, and Europe tax rates are calculated automatically based on the store and customer’s location. While checkout, the customer will be charged a proper tax rate according to country and regional tax rules.

Tax laws are constantly changing. Country, state, or even city government may apply new tax rates that a business owner is expected to keep up with. Your online store will stay up to date on the tax law.

To enable automatic taxes:

- Enter your actual company address in your store admin > Settings > General page. This address is needed to calculate and apply the right rate to the order on the checkout.

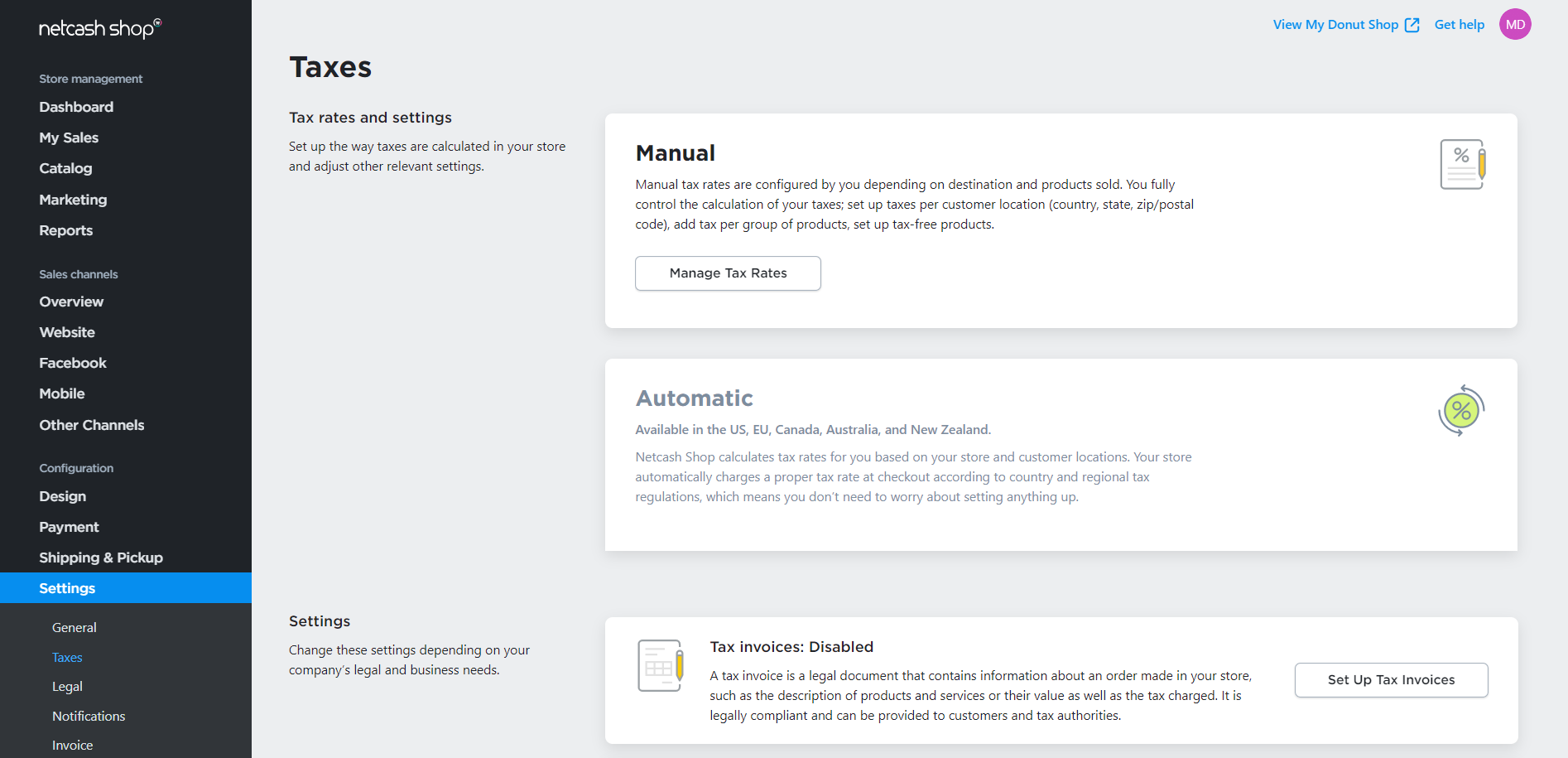

- Enable automatic taxes in your store admin > Settings > Taxes page:

That’s it!

That’s it!

Once enabled, the automatic tax rate will determine a precise tax rate at checkout depending on where you and your customers are located. The tool knows the tax rules in your country, state, and even county and city and applies them properly to each order:

- Whether you’re located in a region with origin-based or destination-based tax scheme.

- Whether shipping costs or discounts are taxable.

- Whether you should charge tax in another state or country not.

The tax rate is calculated with a zip code accuracy. If your customer provides zip+4, it will be calculated with even higher precision. In some states (and the number of such states is growing), the tax is calculated with a street address level precision.